To make an Income Tax payment today for Tax Year 2023…

- Jump to Direct Pay

- Or go to IRS.gov, Select Make a Payment, then Pay Now with Direct Pay, Make a Payment

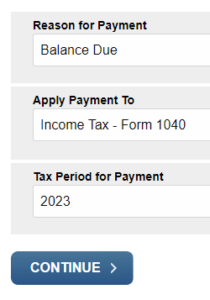

- Select the Reason for Payment, Type of Tax, and Tax Year as indicated here ->

- Verify Identity

- The next screen will ask you to verify your identity using a prior year tax return. You can select 2022 or 2023. Enter the address and filing status based on the chosen tax year.

- REMEMBER, you are paying 2023 tax, just using 2022 or 2023 to verify identity. If you select 2022, be sure to use the address that was on your 2022 tax return if different than your current address. The address must match exactly.

- Payment

- Enter your banking information to make the payment, it may ask you to confirm your SSN again.

- Confirmation Page

- Print a PDF of the webpage confirmation. Please note the email confirmation does not show the amount, so you will need to save this page.

- Upload the confirmation to me in your Client Portal.

To make an Estimated Tax payment today…

- Jump to Direct Pay

- Or go to IRS.gov, Select Make a Payment, then Pay Now with Direct Pay, Make a Payment

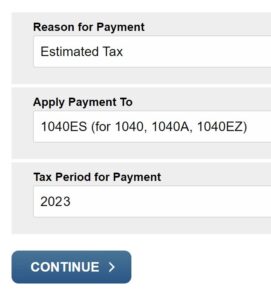

- Select the Reason for Payment, Type of Tax, and Tax Year as indicated here ->

- Verify Identity

- The next screen will ask you to verify your identity using a prior year tax return. You can select 2021 or 2022. Enter the address and filing status based on the chosen tax year.

- REMEMBER, you are paying 2023 tax, just using 2021 or 2022 to verify identity. If you select 2021, be sure to use the address that was on your 2021 tax return if different than your current address. The address must match exactly.

- Payment

- Enter your banking information to make the payment, it may ask you to confirm your SSN again.

- Confirmation Page

- Print a PDF of the webpage confirmation. Please note the email confirmation does not show the amount, so you will need to save this page.

- Upload the confirmation to me in your Client Portal.