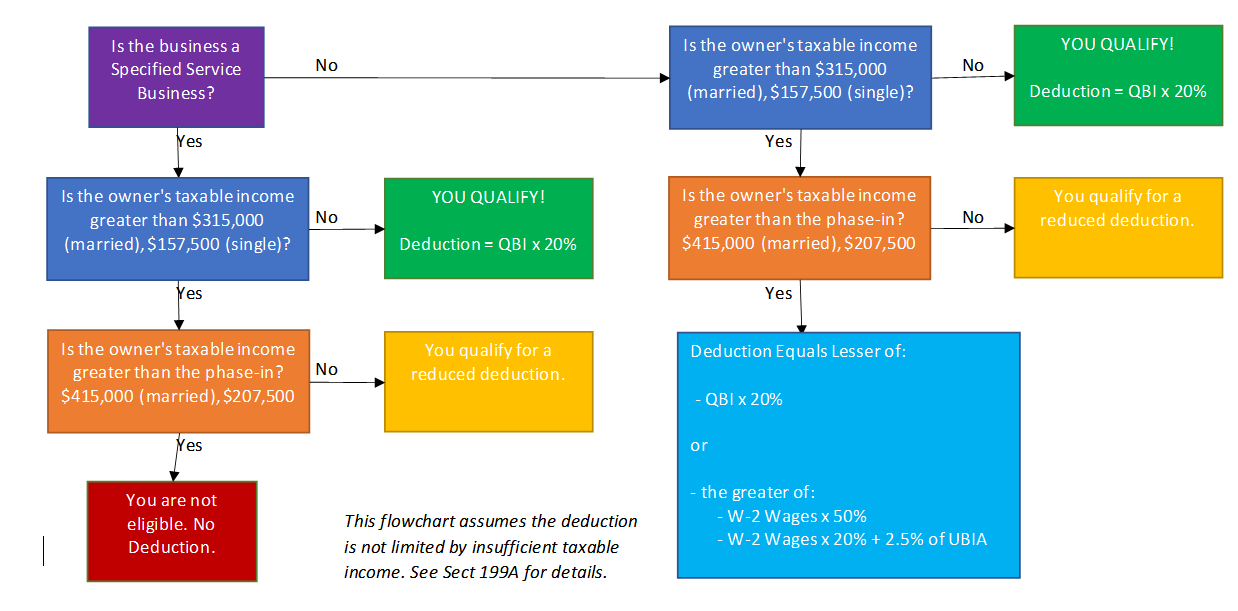

Beginning 2018, eligible taxpayers may be entitled to up to a 20 percent deduction from Qualified Business Income, thus lowering their taxable income and federal tax due. This law was passed to help some small business entities receive a similar tax break as the “C” Corporations are receiving. Below is a general guide to your eligibility for the deduction, place a checkmark next to the YES or NO.

Is your business an S-Corp, Sole Proprietor, or Partnership?

____ Yes (continue to flowchart) ____ No (you are not eligible)

DEFINITIONS RELATING TO SECTION 199A:

- Specified Service Business

- Specified service trade or business (SSTB), includes a trade or business involving the performance of services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, investing and investment management, trading, dealing in certain assets or any trade or business where the principal asset is the reputation or skill of one or more of its employees.

- Qualified Business Income (QBI)

- The pass-through net income of the business that may be subject to the 20% deduction.

- Partial Deduction

- The deduction will decrease as the income increases to the phase-in limit. When the income hits the limit then the deduction is zero.

- Not Eligible / No Deduction

- You will pay ordinary tax rates with no Section 199A deduction.

- Wages Paid

- Total W-2 wages paid by the business.

- Unadjusted Basis Immediately after Acquisition (UBIA)

- UBIA is the Unadjusted basis immediately after acquisition of qualified business property.

Please note, this is not a complete list. Consult your tax preparer and Sect 199A for more information.